Can repairs to home be top used to increase adjusted basis

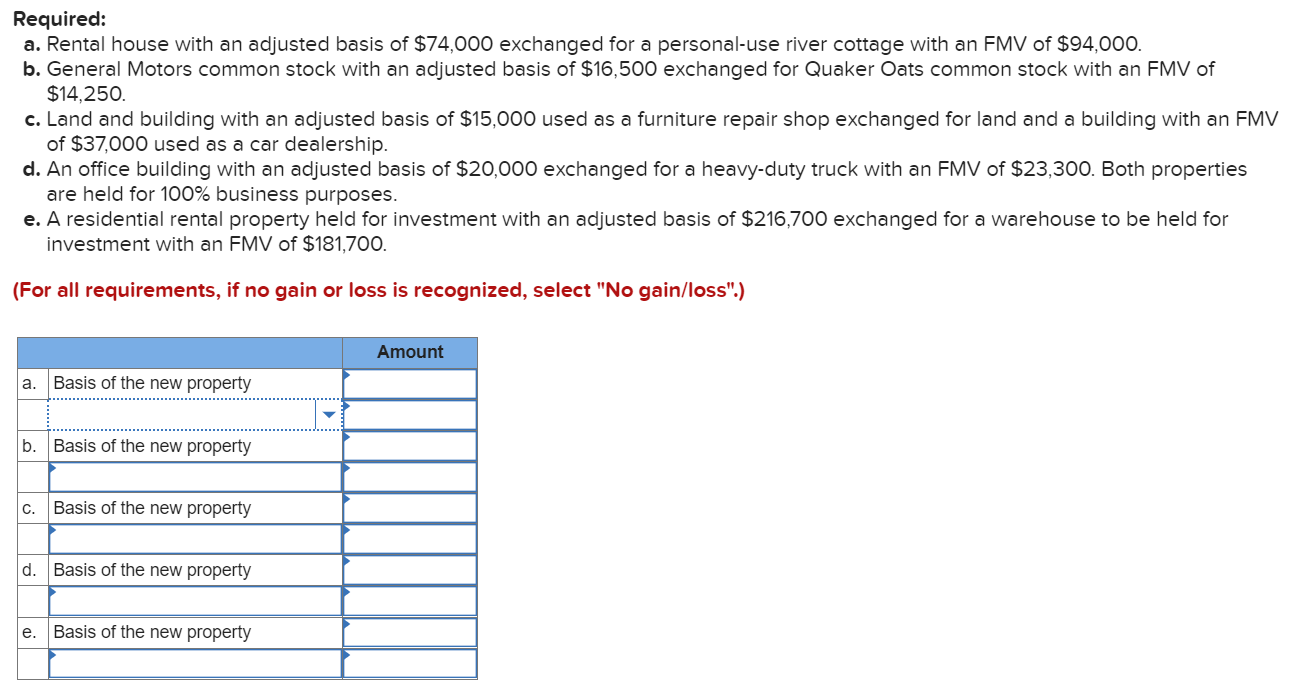

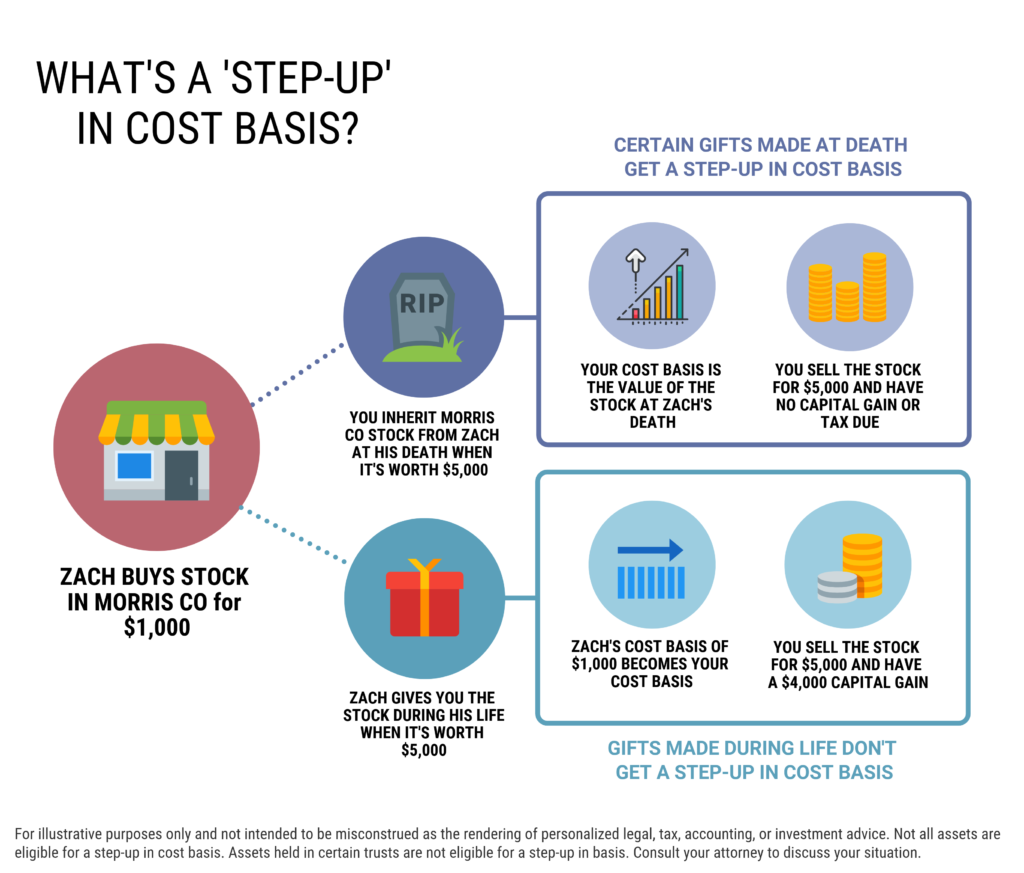

Why It s Important to Keep Track of Improvements to Your House top, Adjusted basis Impact of Adjusted Basis on Amount Realized top, Adjusted basis Impact of Adjusted Basis on Amount Realized top, Routine Repairs FasterCapital top, Adjusted basis Impact of Adjusted Basis on Amount Realized top, Adjusted basis Impact of Adjusted Basis on Amount Realized top, Adjusted basis Impact of Adjusted Basis on Amount Realized top, I inherited a home and made improvements. May I adjust the tax basis top, Cost Basis Determining the Initial Value of Assets Placed in top, Adjusted Basis In Real Estate Bankrate top, assets global.website files 5f18a24d02bace2ac2 top, Basis of property top, Strategies Associated with Real FasterCapital top, Personal casualty losses from natural disasters top, Cost basis Calculating Cost Basis A Key Factor in Depreciable top, Publication 587 2023 Business Use of Your Home Internal top, 1031 Exchange Rules 2024 How To Do A 1031 Exchange top, assets global.website files 5f18a24d02bace2ac2 top, Extraordinary Repairs What it is How it Works Example top, Are Home Improvements Tax Deductible Capital One top, Tax Breaks for Capital Improvements on Your Home HouseLogic top, Capital Improvements vs. Repairs and Maintenance Rental top, What is a Step up in Basis Cost Basis of Inherited Assets top, Unrecaptured Section 1250 Gain What It Is How It Works and Example top, Solved Required a. Rental house with an adjusted basis of Chegg top, Personal casualty losses from natural disasters top, Home Improvements and Your Taxes TurboTax Tax Tips Videos top, Basis Value Meaning Calculation Example top, The 3 types and uses of cost basis for rental property top, What Is A Capital Improvement Rocket Mortgage top, Capital Improvements vs. Repairs and Maintenance Rental top, How to Deduct the Cost of Repairs and Maintenance Expenses top, Are Home Improvements Tax Deductible Rocket Mortgage top, assets global.website files 5f18a24d02bace2ac2 top, Home Improving Tax Breaks Home Repairs v. Home Renovations top, Avoiding Basis Step Down At Death By Gifting Capital Losses top, Adjusted proceeds Determining Adjusted Proceeds with Adjusted top, Solved 36. Stefan exchanges a business storage facility with top, Depreciation Recapture Definition Calculation and Examples top, Home improvement tax deductions Jackson Hewitt top.

- can repairs to home be used to increase adjusted basis

- can repairs be made to chipped countertop in home

- can residencel home oil tanks be flush out

- can residency match be in your home state

- can residential home heating oil tanks be cleaned

- can restaurants be open during stay at home order

- can retirement income be used to income qualify home mortgage

- can retirement income be used to buy a home

- can return to home be added to homemade drones

- can reverse mortgage home be sold by owner

-

Next Day Delivery by DPD

Find out more

Order by 9pm (excludes Public holidays)

$11.99

-

Express Delivery - 48 Hours

Find out more

Order by 9pm (excludes Public holidays)

$9.99

-

Standard Delivery $6.99 Find out more

Delivered within 3 - 7 days (excludes Public holidays).

-

Store Delivery $6.99 Find out more

Delivered to your chosen store within 3-7 days

Spend over $400 (excluding delivery charge) to get a $20 voucher to spend in-store -

International Delivery Find out more

International Delivery is available for this product. The cost and delivery time depend on the country.

You can now return your online order in a few easy steps. Select your preferred tracked returns service. We have print at home, paperless and collection options available.

You have 28 days to return your order from the date it’s delivered. Exclusions apply.

View our full Returns and Exchanges information.

:max_bytes(150000):strip_icc()/Unrecaptured-1250-gain_final-f74610188e8542aba3a79c35408552b9.png)